6 min read

6 min read

A silver lining in the COVID-19 pandemic: people have found the great outdoors. In Japan, COVID-19 boosted an outdoor trend and in 2020 the Japanese outdoor gear market size reached an overwhelming 4.45 billion USD. The market has its particularities and is very different from the Nordic tradition of “roughing it” in the woods with a tent and a sleeping bag.

When Japanese Go Wild

Freedom to Roam or Everyman’s Right define a lot of the nature relationship in Europe – and especially in the Nordics. In Japan, the ownership over the land – the mountains – narrows down the possibilities to hike and to camp – not to mention starting a fire or picking anything from nature. Designated trails and camping sites are as good as it gets.

The camping sites and trails are still crowded with young men. In 2021 11% of the Japanese went camping, the most prominent segment being men in their twenties with 30%. In the near future, however, we might be looking at a shift in the outdoor market: over half of the women in their thirties were planning to go camping.

More user-friendly camping sites, with hygiene facilities, kitchens, and bathrooms, with easy access with a car have made camping more approachable also for women. Manga and anime – the Japanese comics and animations featuring women campers are reaching the TOP 10 best-selling charts. ゆるキャン△ – Yurucamp – for example, has already sold over 6 million copies and it has been adapted into animations, TV drama, games, and different types of fan events. Could the success of Yurucamp signal the changing landscape of the outdoor market? What kind of products and services this growing segment might need?

Walking into the woods without experience sounds quite a stretch for many beginners. Fortunately, glamping – glamorous camping – gives a soft landing to the outdoor culture. More and more extravagant camping sites offer the most instagrammable scenery, without wetting one’s feet – or freezing them.

Inn the Park, a glamping site in Shikoku, for example, is conveniently located a one-hour bullet train ride from Tokyo. You’ll stay a safe distance off the damp ground – and the bugs – floating in mid-air in a geodesic dome stretched in between giant Japanese cedar trees. A mesmerizing – and the most instagrammable view in the middle of the night – glowing cocoons floating in the air in the dark forest. Welcomed with pressed linen, electric lights, bottled water, and a tiny air-conditioner humming and cooling down the tent. By the sunset, you’d soak your weary bodies in a sento – a Japanese hot spa – in the main building. At the dinner, you’ll be served modernized local specialties and local micro-brewery IPA’s.

The biggest growth segment in the Japanese outdoor gear market in 2020 was car camping, including gear such as chairs, tents, and cooling boxes, followed by tarps, shades, and tables. It’s not even surprising to see some enthusiasts unpack a tent sauna from a camper van and pitch it by a river.

On the other hand, solo camping has grown into a trend, and some are going to places where they haven’t dared before. As a counter-movement to camping sites, people are purchasing or renting isolated forest lots just to pitch the tent in the woods and set – otherwise forbidden – campfires. What kind of outdoor gear this movement will be looking for? Where might it develop next?

Safely Indoors

The ‘gorpcore’ trend brought the Patagonia fleeces and North Face windbreakers into the cityscape at the end of the last decade. In Japan, local brands such as Snow Peak, Montbell, Nanga, and Yamatomichi have appeared on the streets alongside their western equivalents.

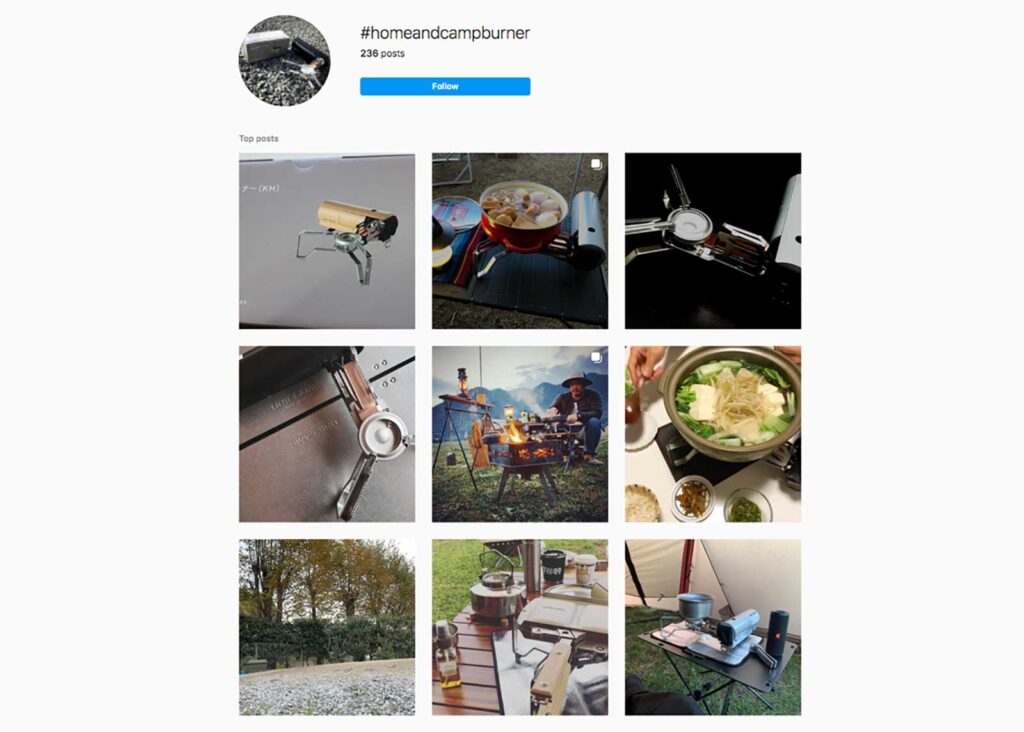

The Japanese consumers however push the trend a few inches further and put the regular Patagonia and North Face folk to shame. Many have brought camping gear e.g. furniture and kitchen utensils to everyday and home use for their small size, foldability, modularity, and stackability. And during COVID-19 Instagram started to fill with pictures of people home-camping tagged #家キャン – “home camp”. One in four people buying camping gear chooses gear that they can use also at home.

Snow Peak has caught up with this – and partially created the trend – with gear for urban outdoor. Lately, their designs have started to express lifestyle rather than outdoor. Their bestseller gas burner is aptly named Home & Camp Burner. A quick look in Instagram under the hashtags #snowpeak and #homeandcampburner shows how roughly half of the use cases are actually indoors. The same applies to many of the other products too. They are not used only – if at all – in the woods or even in the camping area, but at home.

Lisa Yamai, the granddaughter of the founder of Snow Peak Yukio Yamai and a graduate of Bunka Fashion Graduate University joined the company to lead the design of their first apparel line. In 2020 she was appointed as the CEO and took to steer the company in the changing market. We’re reading this as a signal of Snow Peak’s strategic focal point moving ever stronger towards apparel and fashion. Does Snow Peak point to the future direction of the Japanese outdoor industry – and flirting more and more with fashion?

The common denominator for all these different ways to enjoy nature or the outdoor culture is sharing it on Instagram or Twitter: the latest innovative gear and hacks, and little personal rituals. Many of these include pictures of cooking elaborate – and visually appealing – dishes with minimum gear or even going full-on barista – no matter whether it’s outdoors, safely indoors in the home kitchens, or somewhere in between.

• Do you recognize opportunities from the existing outdoor market for your brand?

• How might your brand leverage the emerging outdoor trends?

• What other industries might learn from the shifts in the outdoor market and culture?

Jaakko Kalsi

Jaakko is the co-founder and the Head of Insights of Shop Consulting Ltd. He lives between Helsinki and Tokyo.

In Bubbling Under we identify emerging trends, shifts in the Japanese society, and other subjectively interesting phenomena and discuss them in relation to the Japanese consumer mindset.

Planning to enter the Japanese market? Don’t hesitate to contact us to learn more about how we can grow your business together. We look forward to making new friends!